Insurance for Biologics: Coverage, Costs, and What You Need to Know

When you need a biologic drug, a complex medication made from living organisms, often used for autoimmune diseases, cancer, or chronic conditions. Also known as biologics, these drugs are different from traditional pills—they’re injected or infused, expensive, and often require special handling. If your doctor prescribes one, you’re not just facing a high price tag—you’re stepping into a maze of insurance rules that can make or break your treatment.

Most insurance plans cover biologic drugs, specialized medications derived from living cells, used to treat conditions like rheumatoid arthritis, Crohn’s disease, and psoriasis, but they don’t treat them like regular prescriptions. You’ll likely need prior authorization, a process where your doctor must prove the drug is medically necessary before the insurer agrees to pay. That means paperwork, delays, and sometimes denials—even if the drug is the only thing keeping you functional. Many people don’t realize that even with insurance, out-of-pocket costs for biologics can hit $1,000 a month or more. Some plans put them in the highest tier of drug coverage, meaning you pay a percentage of the cost, not just a flat copay.

It’s not just about approval—it’s about staying covered. Insurance companies often force you to try cheaper drugs first, even if they’ve failed before. They might switch you to a different biologic mid-treatment, just because the new one has a better rebate deal. And if you lose your job or switch plans? You could lose access overnight. That’s why many patients rely on pharmacy benefits managers, third-party companies that manage drug coverage for insurers, often controlling which biologics are approved and at what cost to navigate these hurdles. But these aren’t your allies—they’re profit-driven middlemen. You need to know your rights: federal law says insurers can’t deny coverage for medically necessary biologics without a valid reason, and you have the right to appeal.

There are ways out. Manufacturer assistance programs often cover copays or even the full cost for people who qualify. Nonprofits like the Patient Access Network Foundation and the HealthWell Foundation help with out-of-pocket costs. Some states have laws that limit how much you can be charged for biologics. And if you’re on Medicare, Part D plans must cover at least two biologics in each therapeutic category—but you still need to check your plan’s formulary.

What you’ll find below are real stories and practical guides from people who’ve been through this. How to fight a denial. Which biologics are most likely to be covered. What questions to ask your pharmacist before you even fill the script. How to avoid being dropped from coverage mid-treatment. And what to do when your insurance says no—again. This isn’t theory. It’s what works when your health depends on it.

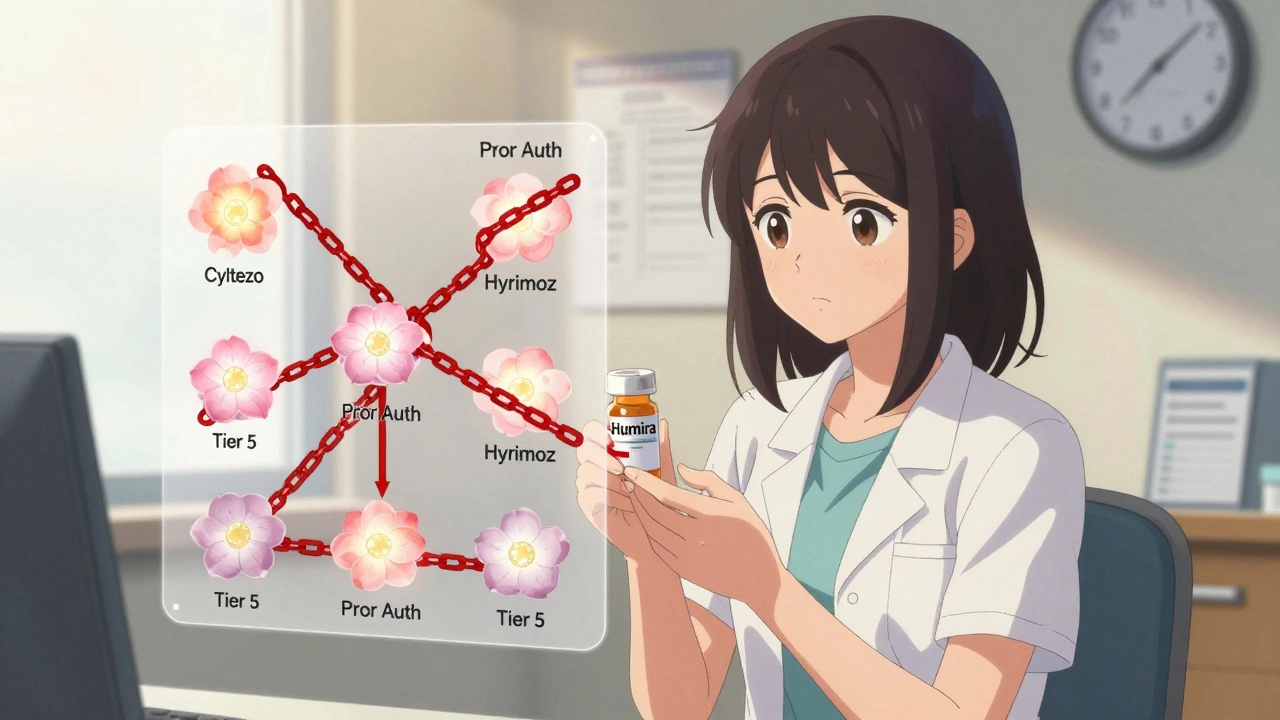

Insurance Coverage of Biosimilars: How Prior Authorization and Tier Placement Block Savings

Despite FDA approval of over 70 biosimilars, most insurance plans still treat them the same as expensive biologics like Humira-same tier, same prior authorization. This blocks savings and delays patient access.

VIEW MORE