Biosimilars Insurance: What You Need to Know About Coverage and Costs

When you hear biosimilars, highly similar versions of complex biologic drugs that are much cheaper than the original. Also known as generic biologics, they work the same way as the brand-name versions but cost up to 80% less. That’s a massive savings—especially for drugs used to treat rheumatoid arthritis, cancer, or diabetes. But here’s the catch: just because biosimilars exist doesn’t mean your insurance will cover them easily.

Insurance companies have a strange relationship with biosimilars. On paper, they love them—lower costs mean lower payouts. But in practice, many still push patients toward the original brand-name drug first. Why? Because of rebates, pharmacy benefit manager deals, and old habits. Some plans require you to try the expensive version before they’ll approve the cheaper biosimilar. This is called step therapy, a process where insurers force patients to try cheaper or older treatments before approving newer ones. It’s not always about safety—it’s about contracts. And if your doctor writes a prescription for a biosimilar, the pharmacy might not even stock it, or your insurer might refuse to pay unless you jump through hoops.

That’s where drug pricing, the real cost of medications after insurance discounts, rebates, and copays are applied. comes in. Biosimilars aren’t always cheaper at the pharmacy counter because of how rebates are structured. A $500 biosimilar might have a $100 copay, but the brand-name drug might be $600 with a $120 copay—so you’re still saving, but not as much as you’d think. And some insurers don’t even list biosimilars in their formulary unless you fight for them. You might need a letter from your doctor, proof of prior treatment failure, or even a prior authorization form that takes weeks to process.

What’s worse? Many patients don’t even know they’re being switched. Pharmacies sometimes substitute a biosimilar without telling you, and if you’re not checking your explanation of benefits, you might not notice the change—until your bill doesn’t match what you expected. That’s why understanding your insurance coverage, the specific rules your plan has for which drugs it pays for and under what conditions. matters more than ever.

There’s good news, though. Federal rules now require insurers to treat biosimilars as equally effective as the originals. Medicare Part D plans must cover them without extra barriers. Medicaid programs in most states have updated their policies. And more private insurers are starting to drop the step therapy requirement—especially as biosimilars prove themselves in real-world use over the last five years.

But until every plan plays fair, you need to be your own advocate. Know your drug’s name, ask if a biosimilar is available, check your plan’s formulary online, and call your insurer if you’re denied. Save every denial letter—you’ll need it if you appeal. And if your doctor supports the switch, make sure they write "do not substitute" only if absolutely necessary. Most of the time, you’re better off with the biosimilar.

Below, you’ll find real stories and practical guides on how to navigate this system. From how to challenge an insurance denial to which biosimilars are actually saving people money right now, these posts give you the tools to make smarter, cheaper, and safer choices with your medication.

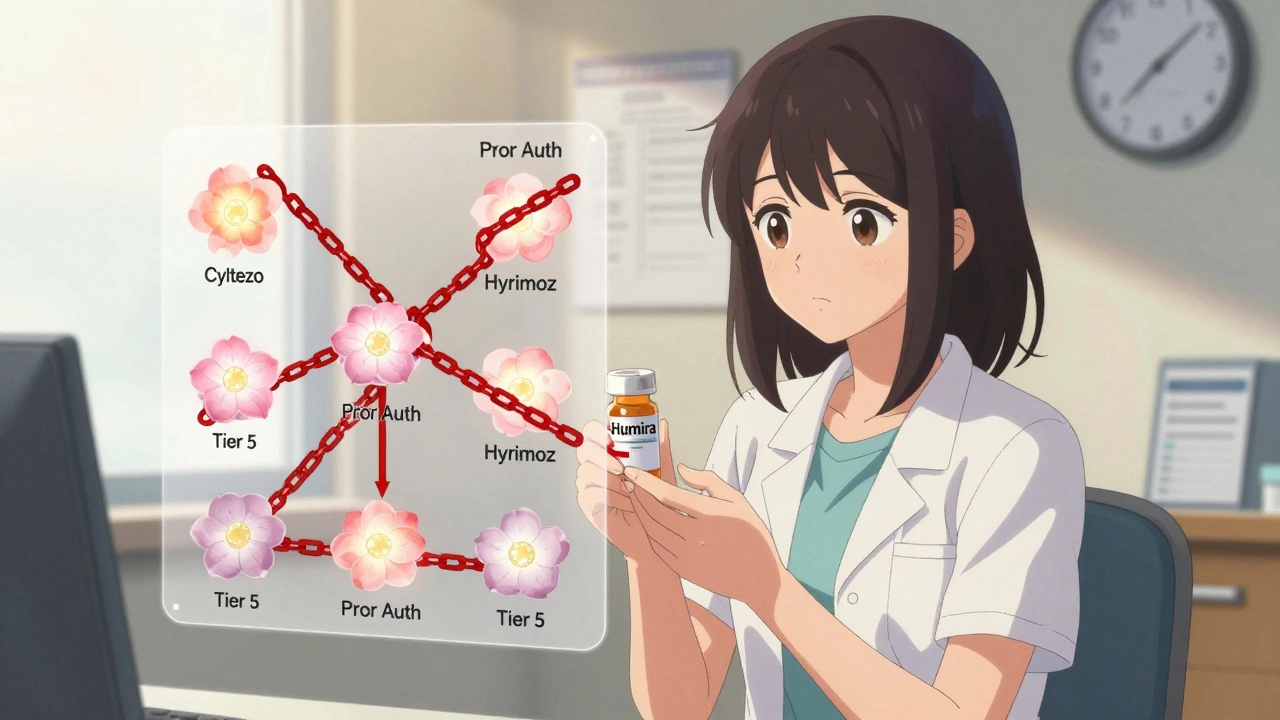

Insurance Coverage of Biosimilars: How Prior Authorization and Tier Placement Block Savings

Despite FDA approval of over 70 biosimilars, most insurance plans still treat them the same as expensive biologics like Humira-same tier, same prior authorization. This blocks savings and delays patient access.

VIEW MORE